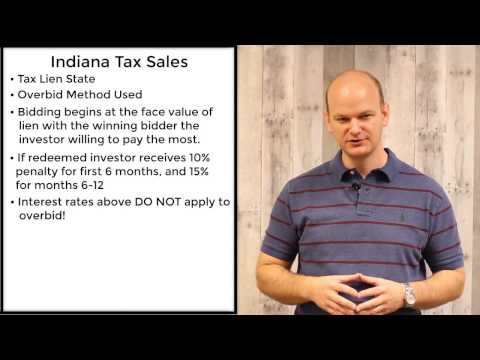

Hey everyone, Casey here. Today, we're talking about tax cells in the state of Indiana. Now, Indiana is a tax lien state. This means that when a property owner fails to pay their taxes, the taxes become delinquent. The county then sells a lien against the property, not the actual property itself. This lien gives the investor the right to collect the past-due property taxes with interest. As a tax lien holder in Indiana, the state uses what is known as an overbid auction method. The auction starts with a minimum bid consisting of the delinquent taxes, penalties, and interest owed on the property. Bidders compete to determine who will pay the highest amount of money for the lien. The return that the tax lien investor will receive for their investment is a flat 10% penalty for the total paid for taxes and fees during the first six months. If the property is redeemed between months six and twelve, the penalty increases to a flat 15%. It's important to note that these penalties only apply to the taxes and fees involved, not the overbid. The overbid, which is the difference between the original bid and the amount the investor has paid for the lien, receives 5% interest per year. This is separate from the penalty previously discussed, which only applies to the actual taxes and fees. The redemption period for tax liens in Indiana is one year. After that time, foreclosure can occur following specific methods outlined by state statute. The registration process for tax liens varies depending on the county, but it is usually a fairly easy process. Many counties even offer online bidding through their own software or through a popular third-party service in Indiana called SR I Services, which can be found online at SRIServices.com. If tax liens are not sold...

Award-winning PDF software

Indiana real estate sales Form: What You Should Know

Indiana Conditional Real Property Purchase and Sale Agreements & Lease — forms Indiana Conditional real property purchase agreements & lease documents form which forms you can use to complete Indiana Conditional Real Property Purchase & Sale Agreements & Lease Indiana Conditional Real Property Purchase & Sale Agreements — State of Indiana Legal Forms Choose from real property purchase agreements, deeds, landlord tenant forms and those forms which have no legal implications as far as that state is concerned. How to Fill Out a Real Estate Contract in Indiana: How to Fill Out a Real Estate Contract in Indiana — State of Indiana Legal Forms Choose from real property purchase agreements, deeds, landlord tenant forms and those forms which have no legal implications as far as that state is concerned. How Do I Fill Out a Real Estate Contract in Indiana: How Do I Fill Out a Real Estate Contract in Indiana — State of Indiana Legal Forms Choose from real property purchase agreements, deeds, landlord tenant forms and those forms which have no legal implications as far as that state is concerned. Indiana Conditional Real Property Purchase and Sale Agreement & Lease — forms Indiana conditional real property purchase and sale agreement and lease forms which forms you can use to fill out Indiana Conditional Real Property Purchase and Sale Agreement and Lease How to Fill Out a Real Estate Contract in Indiana: How Do I Fill Out a Real Estate Contract in Indiana — State of Indiana Legal Forms Choose from real property purchase agreements, deeds, landlord tenant forms and those forms which have no legal implications as far as that state is concerned. Indiana Conditional Real Property Purchase and Sale Agreement & Lease — State of Indiana Legal Forms Choose from real property purchase agreements, deeds, landlord tenant forms and those form which have no legal implications as far as that state is concerned.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Indiana Purchase Agreement form with no realtor, steer clear of blunders along with furnish it in a timely manner:

How to complete any Indiana Purchase Agreement form with no realtor online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Indiana Purchase Agreement form with no realtor by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Indiana Purchase Agreement form with no realtor from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Indiana real estate sales